Doha Bank opens in Bangladesh

Doha Bank has formally opened a representative office in Bangladesh, the first bank from the Gulf region to do so. The office has been launched to support Bangladeshi investors and their investment in the Gulf region. R Seetharaman, chief executive officer of Doha Bank, made the announcement at a press conference in Dhaka on Thursday. Doha Bank is one of the largest commercial banks in the state of Qatar. It has branches in the UAE, Kuwait and India with representative offices in the UK, Germany, Turkey, Singapore, China, South Korea, Japan, Hong Kong, Australia, Canada and South Africa. Seetharaman said: “The representative office will initially work as a corresponding bank for local banks by supporting them in receiving foreign credit lines and make it easier for Bangladeshis to collect remittance.

Source: http://www.dhakatribune.com/business/banks/2016/12/08/doha-bank-opens-bangladesh/

BB heist: CID finds 23 foreigners’ involvement

Criminal Investigation Department (CID) of police today claimed that they have identified 23 foreigners who collected the Bangladesh Bank heist money from the Philippines casino and handed over to the mastermind. “Apparently, the mastermind of the heist collected the transferred money though Philippines casino and cashed out the sum using 23 field operatives,” Additional Deputy Inspector General Shah Alam of CID (Organised Crime) told reporters at Police Convention Centre in Dhaka today. “We are trying to know the identity of mastermind by interrogating these people through the intelligence departments of the concern countries, he said.Cyber criminals stole $101 million from the BB account with the Federal Reserve Bank in February. The incident came to light several days later. In the Philippines, $81 million was transferred to four bank accounts opened with deposits of only $500 each. However, in Sri Lanka, payment of $20 million was stopped by the bank concerned.

Source:

http://www.thedailystar.net/business/bb-heist-cid-finds-23-foreigners-involvement-1328122

http://www.dhakatribune.com/bangladesh/crime/2016/12/10/cid-23-foreigners-behind-bb-heist/

http://www.thefinancialexpress-bd.com/2016/04/18/26747/CID-finds-twenty-foreigners’-link-in-BB-reserve-heist

Monetary policy for H1 on right tract: BB

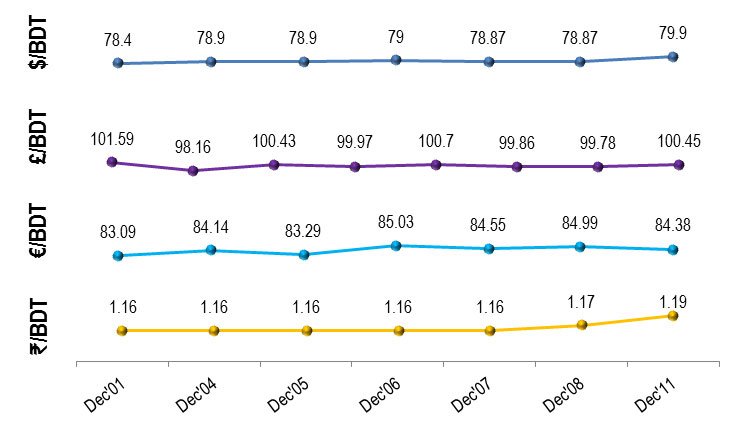

Bangladesh Bank (BB) says the monetary policy for the first half (H1) of fiscal year 2016-2017 (FY17) is on right tract to help the government achieve its 7.2 per cent growth and keep inflation at it expected level of 5.8 per cent. “Inflation, exchange rate and credit flow to private sector are in a very comfortable zone which indicates that the central bank’s monetary policy targets for H1 are on right direction,” BB chief economist Biru Paksha Paul has said. He mentioned that the rate of point to point inflation stood at 5.38 per cent in November. “The present trend of inflation indicates that the target of keeping the rate of inflation within 5.8 per cent in line with the current budget is very much possible,” he said.

Source:

http://www.thefinancialexpress-bd.com/2016/12/10/55913/Monetary-policy-for-H1-on-right-tract:-BB

http://www.theindependentbd.com/post/71983

Money laundering goes on unabated as watchdogs stay indifferent

Money laundering from Bangladesh has been continuing unabated as the relevant government authorities remain indifferent to this financial scourge, experts said. A section of traders backed by influential people in the government and political parties are engaged in laundering money to foreign havens and shifting the capital in the name of investment in fake overseas enterprises. Despite of occasional media uproar and anti money laundering activities by the relevant government agencies and the banks, money laundering and flight of capital could not be stopped over the past years rather these foul practices intensified further. Nearly US$57 billion equivalent to Tk 456,000 crore were laundered away from the country in 10 years from 2004 to 2013. Only in 2013, ahead of national elections due on January 5, 2014, about $10 billion or Tk 80,000 crore was laundered.

This staggering figure taken out of the country by laundering were revealed by former Bangladesh Bank Governor Mohammed Farashuddin at a discussion meeting held in the capital on Friday in observance of the International Anti-Money laundering Day

Source: http://www.observerbd.com/details.php?id=47756

Govt banks heavily on savings tools, cuts bank borrowing

The government has deeply downsized by nearly Tk 54 billion its targeted bank borrowing for the current fiscal year amid tremendous fund flow from the national savings schemes which are rather costlier. Also, this switch stands somewhat contradictory to government’s stipulated budgetary policy on raising funds through borrowing from the country’s banking system. The government in its latest revision has set a new target for borrowing from the banking system at Tk 335.5 billion, down by nearly Tk 54 billion from the original estimation laid down in the budget documents. However, it kept the borrowing target from the domestic sources the same as set in the budget documents — Tk 615.5 billion in total — to feed the budget financing.

Source: http://www.thefinancialexpress-bd.com/2016/12/09/55835/Govt-banks-heavily-on-savings-tools,-cuts-bank-borrowing

Mobile money drives financial inclusion

Financial inclusion expanded 8 percentage points year-on-year in 2015, driven by growth in mobile money, according to a recent study. About 43 percent of Bangladeshis are financially included, says the study conducted by Washington-based research company InterMedia with funding from the Bill and Melinda Gates Foundation based on statistics of 2015. Of the figure, 24 percent of citizens are covered by non-bank financial inclusion and 19 percent have full-service bank accounts. Of them, 9 percent have mobile money accounts. There were 3.9 crore registered mobile financial service accounts in Bangladesh until October this year, with only 1.38 crore active, according to the central bank. Customers transferred Tk 20,692.43 crore in 12.85 crore transactions in October this year, according to central bank statistics.

Source: http://www.thedailystar.net/business/mobile-money-drives-financial-inclusion-1328455

Bangladesh Bank for cash incentives to merchant ship business

Bangladesh Bank has recommended the government giving cash incentives to the business of ocean-going ships carrying Bangladesh flag. In a recent letter to Bank and Financial Institutions Division, the central bank said the cash incentives against foreign currency earnings by the business at a rate fixed by the government. Bangladesh Bank also advised bringing the ocean-going ship business under the revised Industrial Policy 2016. According to official data, the number of Bangladesh ocean-going merchant ships declined sharply to less than 30 now from 72 in 2013. Image crisis and double taxation in various international ports have been blamed for the decline.

Source: http://www.dhakatribune.com/business/2016/12/11/bangladesh-bank-cash-incentives-merchant-ship-business/

Foreign funds in stocks jump nine times

Net foreign investment in the capital market soared almost nine times in the first 11 months of the year, as overseas investors continue to pour funds into Bangladesh’s stockmarket seen as a frontier and emerging market by many. Foreign investors bought shares worth Tk 4,376.27 crore and sold shares worth Tk 3,421.02 crore to take their net investment for the January-November period to Tk 955.25 crore. A year earlier, the net investment by foreigners stood at Tk 106.53 crore, according to data from Dhaka Stock Exchange. Positive macroeconomic indicators, including stable exchange rate and a steady political scenario, boosted the foreign investors’ confidence, analysts said. Also, the recent trend of pulling funds out of the neighbouring stockmarkets including India created an opportunity for Bangladesh to receive more investment as a frontier and emerging market. Foreign investors have pulled out around $5 billion from the Indian capital markets in November amid concerns over the impact of demonetisation coupled with fears of rate hike by the US Federal Reserve, according to media reports.

Source: http://www.thedailystar.net/business/foreign-funds-stocks-jump-nine-times-1328452

Germany has overtaken the US as the Bangladesh’s largest export market in five months of the current fiscal year because of a huge rise in export earnings from the EU country against a slowdown in the elections-gripped US market. Export earnings boost from major EU countries, including Germany, helped the country heal the bruises it suffered from the downward trend in the US and the Brexit-hit UK markets in the July-November period of the FY 2016-2017. Although the US remained the Bangladesh’s largest export destination until September this year, Germany from October started to overtake the North American country, buoyed by solid economic activities in Europe against stagnancy in demand in the US amid a bitter election campaign, said exporters and economists.

At least 20 Malaysian companies expressed interest to invest in various sector of Bangladesh in the coming days. “We are closely working with them for further partnership,” President of Bangladesh Malaysia Chamber of Commerce and Industry (BMCCI) President Md Alamgir Jalil told reporters on Saturday while sharing the outcome of the recently held investment summit in Kuala Lumpur, reports UNB. Malaysian High Commissioner in Dhaka Nur Ashikin Mohd Taib, former BMCCI President and Chairman of Bangladesh Trade and Investment Summit 2016 organising committee Syed Nurul Islam, BMCCI Vice President Syed Almas Kabir, Secretary General Shabbir Ahmed Khan, Treasurer MA Bakar, and former President Syed Moazzam Hossain also spoke at the press conference.

Source: http://www.thefinancialexpress-bd.com/2016/12/10/55889/%E2%80%9820-Malaysian-firms-want-to-invest-in-Bangladesh%E2%80%99